what is an open end equity lease

With the open-ended lease you are guaranteeing the residual or buy out value of the vehicle at the end of the lease term which is structed. There are typically two types of leases.

Open Vs Closed End Leases What To Know Credit Karma

Open End One-month LIBOR 50 percent.

. What is an open ended equity lease. Annual payments are 28500 to be made at the beginning of each year. Suppose your total payout on a 30000 vehicle ends up being 10000 over the course of your contract.

But when you return it the value has dropped by 15000. CLOSED END LEASE COST COMPARISON. TRAC is an acronym for terminal rental adjustment clause However the basic principles of the TRAC lease sometimes are misunderstood.

You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for. This of course is extreme but with an open-end agreement you could end up getting billed for the difference. The lessor then sells the vehicle.

A companyemployer will assume management and leasing of the car to its employees not the leasing company. However if a vehicles actual cash value at the end of the lease is higher than the lessors estimated value the residual value written into the lease the cars higher trade-in value could. It is hard to say if the positive equity will increase after the extra time provided to you.

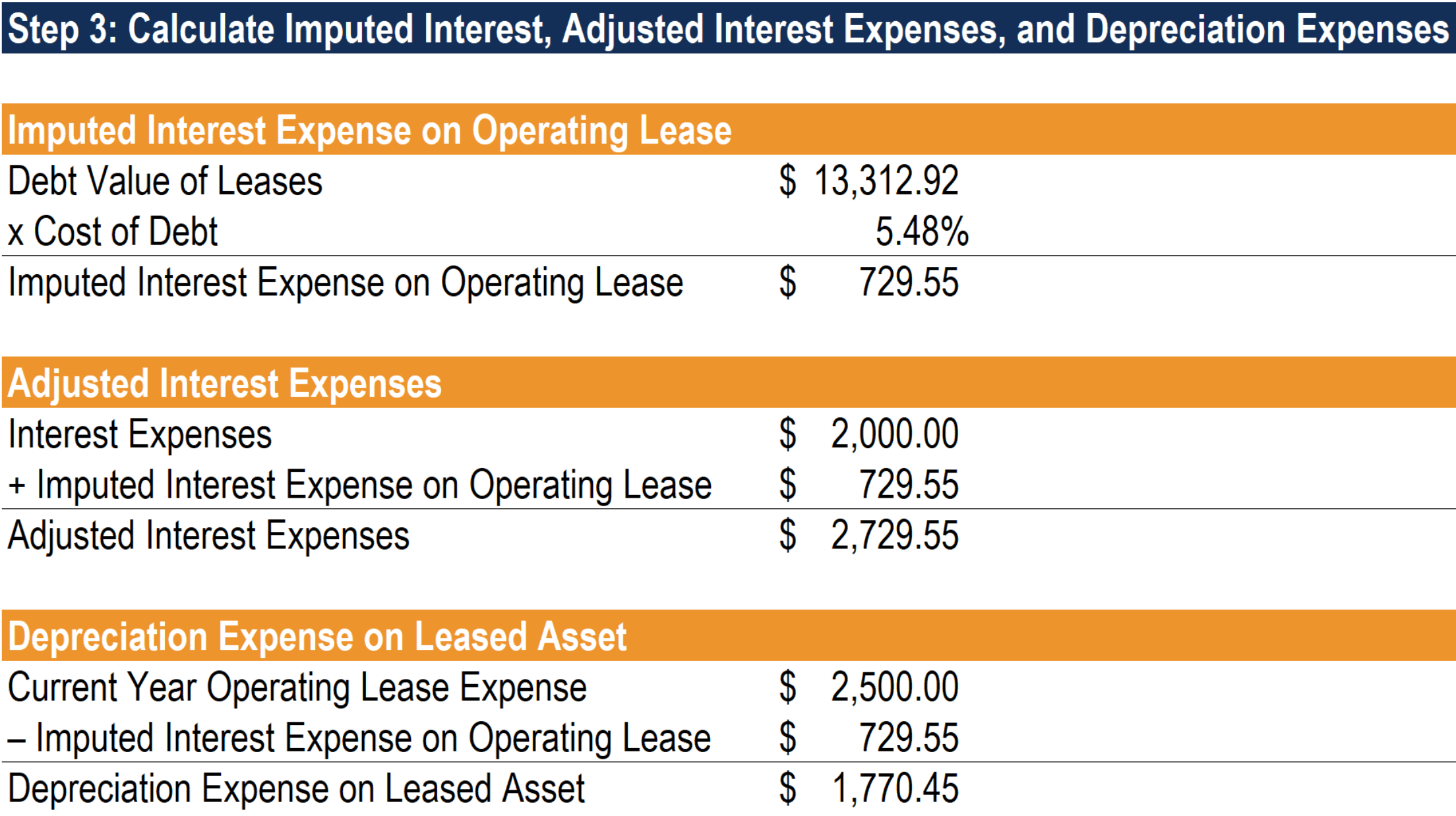

Re-leasing the vehicle will extend the payments for a few months. This happens when the lessee drives less than the mileage allotted. A basic tenet of accounting is matching expense to the time period in which it occurs.

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. In an open-end lease subject to the three-payment rule you are responsible for any difference if the actual value of the vehicle at scheduled termination is less than the residual value stated in your lease deficiency see glossary entry Open-end lease for a definition of the three-payment rule. In an open-end lease the lessee agrees to a minimum term thats usually at least 12 months and can terminate the agreement at any point after the end of the term.

If the proceeds of the sale are greater than what was calculated in the agreement the lessee receives a reimbursement. Open-end TRAC leases enable fleet. What is an open-end lease.

An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease. This works well for employers since the cost of the vehicles can be written-off or expensed. It might not happen but you probably dont want to take that chance.

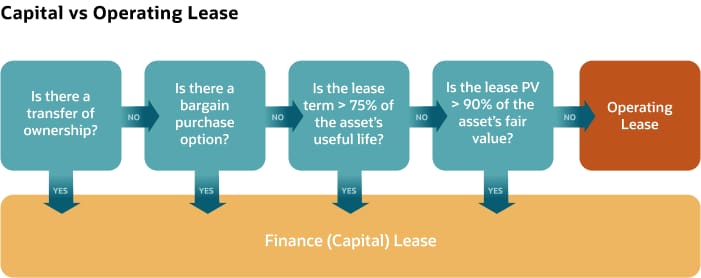

When leasing a car you may have the option of an open-end or closed-end lease. Since leases are designed so that the only time a cars value equals the balance owed is at the end of the lease its not common for there to be equity at the end of the lease term. What is an open ended equity lease.

This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. The open-end TRAC lease has been a staple in the fleet industry for decades. The lessee has the option of purchasing selling or trading-in the leased vehicle at the end of the contract for the GRV.

Ford Taurus with standard fleet equipment. At the end of the lease the equipment will revert to the lessor. It may also be referred to as a capital lease operating lease or TRAC lease With this type of lease your business has the option to retain equity in the vehicle while freeing up capital.

This works well for employers since the cost of the vehicles can be written-off or expensed. Vehicle used 36 months60000 miles. Open-end leases allow the lessee the one who borrows the vehicle to guarantee a value at the end of the lease.

Open-end leases also exist and are most often used in the case of commercial business lending. In a closed. However in an open-end lease you would be able to receive a check from the owner for the difference.

An open-end lease is a type of rental agreement that obliges the lessee the person making periodic lease payments to make a balloon payment at the end of the lease agreement amounting to the difference between the residual and fair market value of the asset. An open-end lease and a closed-end lease. Open-ended lease offer flexibility.

But there can be a major difference between how much you owe at the end of each type of lease. This type of leasing is more often used for commercial purposes because the open-end lease gives unlimited mileages. Lease equity is when your car is worth more at the end of the lease than the buyout that was established when the lease began.

An open-end lease is one in which the lessee a business to be clear these arent available to the general public agrees to accept the financial risk. Lease Term Open-end leases carry a shorter term and usually last a minimum of one year but this type of lease can be extended on a month-to-month basis. On the open-end lease the lessee will use up and pay off a great percentage of those vehicles useful lives so their residual values at end of term are less of a factor.

Closed End Prime 10 percent. The outstanding balance will decrease and the vehicle will continue to depreciate. We just have to think of transport and courier companies they prefer to amortize the real cost of depreciation instead of paying.

He will pay the bill if the depreciation is worse than expected. Closed End 36 months55000 miles07 per mile beyond 55000 miles. Open-end lease contracts are more compatible with businesses that have less predictable but greater mileage requirements than the average 12000 miles-per-year of a non-business lease.

An interest rate of 105 and straight-line depreciation are used. At the end of the lease there are several options available to you including buyout the truck continue with the lease or return and replace the vehicle. The employer takes all the financial risk.

With both types of leases the cars estimated value at the end of the lease term known as the residual value serves as the basis for calculating your monthly payment. The equipment has a useful life of 8 years and has no residual value. Open-end leases are also called finance leasesMay 26 2021.

An open-end lease combines the flexibility of ownership with the potential cash flow and tax advantages of leasing. The lessee will often pay off these vehicles down to a dollar and leave them on the fleet management companys books who will continue to handle the vehicles taxes licensing and management. In most open-end leases you are also entitled to any refund if the actual.

At the time of the lease agreement the equipment has a fair value of 166000. Open End 36 months. This is called the Guaranteed Residual Value GRV and is outlined in the lease contract.

The open-end lease puts all the financial risks on the lessee.

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Operating Lease Learn How To Account For Operating Leases

We Help Landlords Too Being A Landlord Dracut Methuen

Bsq The Only Goal Setting Framework You Will Ever Need Social Media Social Media Marketing Social Strategy

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Lease Accounting Calculations And Changes Netsuite

Hsbc Mutual Fund Launches Hsbc Mid Cap Fund In 2021 Smart Money Growing Wealth Asset Management

Advantages And Disadvantages Of Capital Lease Accounting And Finance Financial Management Economics Lessons

Vintage Domino S Avoid The Noid Pvc Premium Figure Etsy Domino Pvc Original Bags

Lease Accounting Calculations And Changes Netsuite

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

What Is The Difference Between An Open Vs Closed Lease

Personal Line Of Credit Meaning How It Works Benefits And Drawbacks In 2022 Personal Line Of Credit Line Of Credit Types Of Loans

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Real Estate Infographic Real Estate Postcards Investing

Guide To Leasing A Car How It Works How Much It Costs

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

/GettyImages-1149107425-99d2c7fcb6264e13bb34f7746eeabb0d.jpg)